What is Bank Management?

A banking company, like any other company or corporate body, is an artificial person existing only in the eyes of the law. It has a separate legal entity with no physical existence of its own. It acts through the natural human beings that are termed as ‘directors’ and collectively designated as ‘Boards of directors.

It is the supreme authority that manages the affairs of a bank and is responsible for efficient operations and bank management.

The board of directors, by their efficient management and good organizational structure, aims at improving operating efficiency, increasing profitability, and building and retaining public confidence, which will not only attract more deposits but also enhance the scope for expanding the banking business.

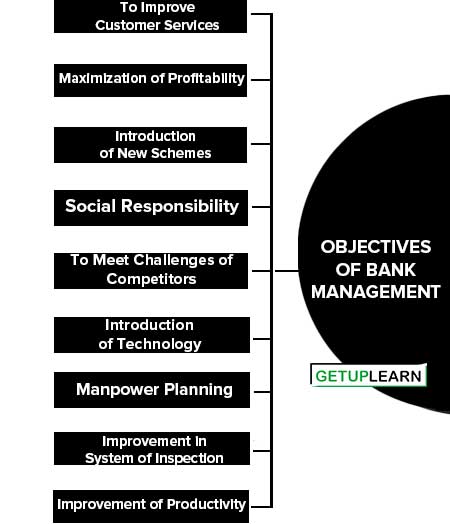

Objectives of Bank Management

The basic objective of the commercial bank’s management in the modern setup is not only to maximize profits but also to discharge social responsibilities. Social responsibilities include responsibilities towards shareholders, employees, customers, other banks, the government, and the weaker sections of society.

Efficient management is a pre-requisite for the success of commercial banks in achieving the following objectives of bank management:

- To Improve Customer Services

- Maximization of Profitability

- Introduction of New Schemes

- Social Responsibility

- To Meet Challenges of Competitors

- Introduction of Technology

- Manpower Planning

- Improvement in System of Inspection

- Improvement of Productivity

To Improve Customer Services

one of the important objectives of bank management is to improve customer service.

Maximization of Profitability

Maximizing profits is the main objective of bank management.

Introduction of New Schemes

The objective of the bank management is to innovate and introduce new schemes to expand the banking business.

Social Responsibility

It is the objective of the bank management to discharge social responsibility towards society, especially its weaker sections.

To Meet Challenges of Competitors

The changing scenario arising from globalisation and liberalization as well as competitors from within and outside has posed a number of challenges before the bank management, which has to be dealt with in an efficient manner.

Introduction of Technology

The bank management aims at computerizing and adopting new technologies to make banking services more efficient and time-bound. The introduction of online banking, ATM facility, internet banking, etc. is the main examples.

Manpower Planning

It is the objective of the bank management to develop its manpower by giving required training. The bank management also motivates its employees to work efficiently, productively, and profitably.

Improvement in System of Inspection

The bank management tries to improve the system of inspection and social audit.

Improvement of Productivity

The bank management makes serious efforts to improve the output of the bank to compete with private banks.

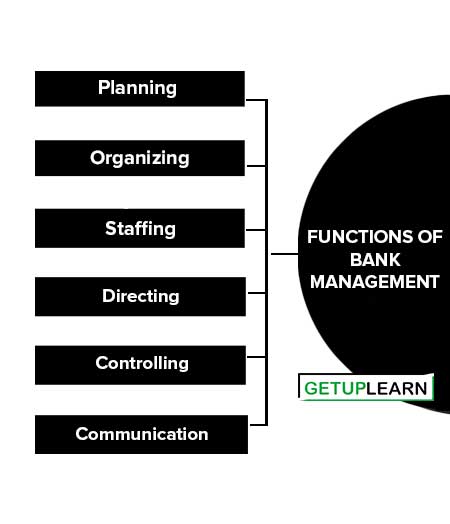

Functions of Bank Management

The fundamental functions of bank management are as follows:

Planning

Planning is the activity through which a bank decides its future course of action. It refers to a set of objectives or goals of a bank and determines the policies, programs, and procedures to achieve pre-decided objectives.

Planning is the bridge between the present and future of a bank. It provides the bank management with some goals, aims, objectives, programs, and direction toward the goals.

Organizing

Organizing is the second important function of bank management. Organising is the process of arranging and allocating the bank activities, authority, and resources among the bank employees so that they can efficiently achieve the goals of the organization.

Organization involves the division of total bank activities into different departments for efficient execution.

Staffing

Staffing is the management of human resources in the organization. Staffing refers to the function of selecting, training, deciding the wages and salary, and appraisal of the work of the members of the bank staff.

The staffing function is concerned with the provision of the right persons, in the right numbers, at the right time, and in the right place in a bank. Staffing involves a sufficient supply of adequately developed and motivated people to perform their duties and tasks required to meet the banking objectives.

Directing

In bank management, directing refers to instructing, guiding, counseling, and supervising the bank staff. it is concerned with leading, motivating, and guiding the staff of the bank to perform activities in the most efficient way to achieve the desired goals.

Controlling

Controlling is the measurement of the performance of the subordinates to ascertain whether or not they have met the objectives of the bank and abided by its established policies and rules.

The control process involves the establishment of standards, measuring performance in accordance with these standards, and correcting deviations from the established plans and programs. Controlling also ensures the efficient use of scarce and valuable resources by the banks. It improves customer services, raises efficiency, and controls frauds and scams.

Communication

It is the process of communicating the established objectives, policies, and rules of operation to all who need them. Communication is the chain of understanding that integrates the staff members of the bank from top to bottom and bottom to top.

Communication is the way of conveying ideas, views, information, and directions from one person to another. Computerization and online banking have become important sources of communication.

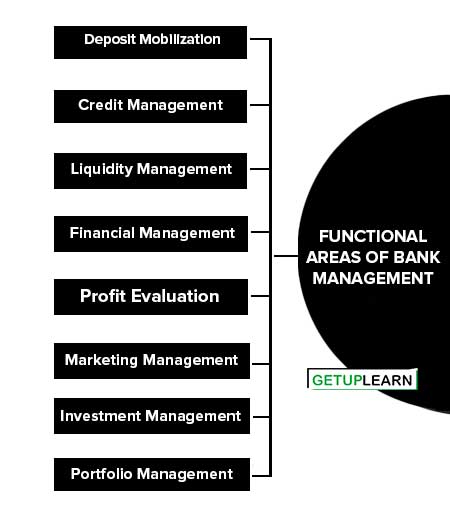

Functional Areas of Bank Management

The functional areas of bank management refer to the important functions to be performed by the staff of the bank. It consists of the following functional areas:

- Deposit Mobilization

- Credit Management

- Liquidity Management

- Financial Management

- Profit Evaluation

- Marketing Management

- Investment Management

- Portfolio Management

Deposit Mobilization

The bank management formulates saving schemes and makes efforts for the mobilization of deposits. Bank management plays an important role in inculcating banking habits.

Credit Management

Credit management refers to the appraisal, sanction, distribution, recovery, and administration of loans and other types of credit.

Liquidity Management

The liquidity of a bank is the main determinant of a bank’s reputation and goodwill. It relates to Cash Reserve Ratio (CRR), statutory Liquidity Ratio (SLR), trading in bank receipts, and other short-term securities.

Financial Management

Financial management includes cost control, financial planning, management accounting, and other related problems.

Profit Evaluation

It is an important functional area of bank management. It requires a dynamic approach. It covers cost-benefit analysis, forecasting, the flow of funds, and estimation of return.

Marketing Management

Marketing management refers to marketing services, customer services, and marketing research.

Investment Management

Investment management is another important functional area of bank management. The main source of a bank’s profits is the investment made by the banks of their deposits. It relates to the underwriting of securities and investment in equities.

Portfolio Management

The portfolio refers to the composition of different types of income-earning assets. This functional area is mainly related to asset management. The bank management has to select, make appraisals and evaluate different types of assets.

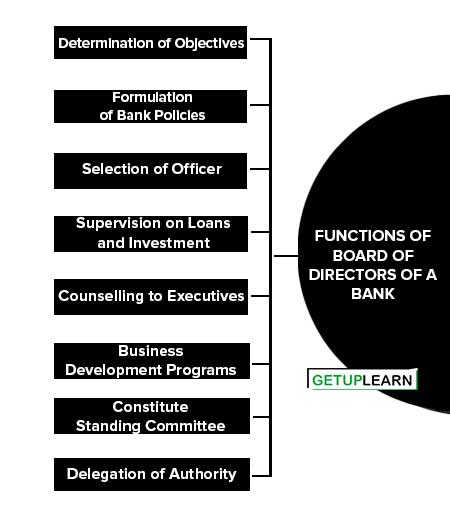

Functions of Board of Directors of a Bank

The success of a bank depends upon how efficiently the ‘board of directors performs its functions. The following are the important functions of board of directors of a bank:

- Determination of Objectives

- Formulation of Bank Policies

- Selection of Officer

- Supervision on Loans and Investment

- Counselling to Executives

- Business Development Programs

- Constitute Standing Committee

- Delegation of Authority

Determination of Objectives

The Board of Directors determines the objectives of the bank’s business which are essential for framing the bank’s policies.

Formulation of Bank Policies

They formulate bank policies that are conducive to the attainment of its objectives.

Selection of Officer

The board of Directors selects the officers keeping in mind the policies of a bank.

Supervision on Loans and Investment

They provide checks on loans and investments and ensure that they are carried out in accordance with the rules and regulations of the banking.

Counselling to Executives

They provide counseling to bank executives and help them in reaching decisions. It also evaluates the performance of executives.

Business Development Programs

They provide help to business development programs by:

- Their vast professional experience and knowledge.

- Mobilizing business for the banks by virtue of their influential position in society.

Constitute Standing Committee

They constitute a standing committee in order to ensure better coordination between various departments. Special committees are also constituted to handle exceptional matters.

Delegation of Authority

They determine the authority and duties of executives to perform their functions properly and efficiently.

FAQs About the Bank Management

What are the objectives of bank management?

The objectives of bank management are:

1. To Improve Customer Services

2. Maximization of Profitability

3. Introduction of New Schemes

4. Social Responsibility

5. To Meet the Challenges of Competitors

6. Introduction of Technology

7. Manpower Planning

8. Improvement in System of Inspection

9. Improvement of Productivity.

What are the functions of bank management?

These are the following functions of bank management: Planning 2. Organizing 3. Staffing 4. Directing 5. Controlling 6. Communication.

What are the functions of board of directors of a bank?

The functions of the board of directors of a bank are:

1. Determination of Objectives

2. Formulation of Bank Policies

3. Selection of Officer

4. Supervision on Loans and Investment

5. Counseling to Executives

6. Business Development Programs

7. Constitute Standing Committee

8. Delegation of Authority.

What are the functional areas of bank management?

The following are functional areas of bank management:

1. Deposit Mobilization

2. Credit Management

3. Liquidity Management

4. Financial Management

5. Profit Evaluation

6. Marketing Management

7. Investment Management

8. Portfolio Management.