What are Bank Deposits?

Bank deposits are savings products that customers can use to hold an amount of money at a bank for a specified length of time. In return, the financial institution will pay the customer the relevant amount of interest, based on how much they choose to deposit and for how long.

The term deposits mean to lay down in a particular place, store, or entrust for keeping”. It means money deposits in banks are known as bank deposits. Deposits are the chief source of funds for the banks. Deposit Management consists of the activities involved in obtaining funds from depositors.

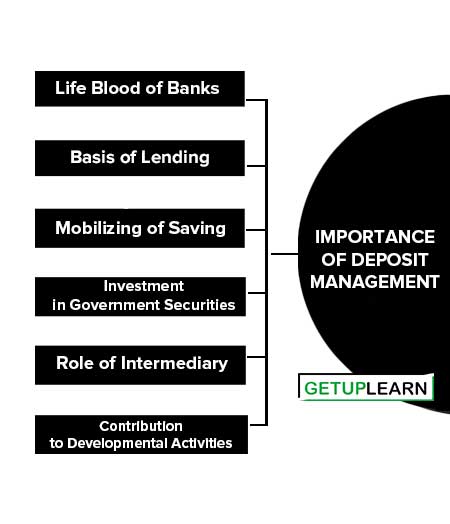

Importance of Deposit Management

The need or importance of deposit management is discussed below:

- Life Blood of Banks

- Basis of Lending

- Mobilizing of Saving

- Investment in Government Securities

- Role of Intermediary

- Contribution to Developmental Activities

Life Blood of Banks

Deposits are the lifeblood of commercial banks. They are the main and very important inputs of banks. No commercial bank can survive without accepting deposits.

Basis of Lending

The lending and investment operations of a bank are influenced by the magnitude of deposits, their composition, and ownership. Deposits are the main inputs for loan output.

Mobilizing of Saving

Banks mobilize the savings of the people through deposits. The deposits mobilized are the money of people, which needs to be managed well. Deposits enable a bank to pool together the savings of a large number of savers.

Investment in Government Securities

The deposits make it possible for commercial banks to make investments in government securities. Banks provide necessary funds to the government for developmental activities.

Role of Intermediary

Commercial banks play the role of an intermediary between depositors and investors. This intermediary role of banks is very important for the economic development of the country.

Contribution to Developmental Activities

Mobilization of resources forms an integral part of the development process in India. Banks have to depend upon the mobilization of deposits from the public to finance development programs.

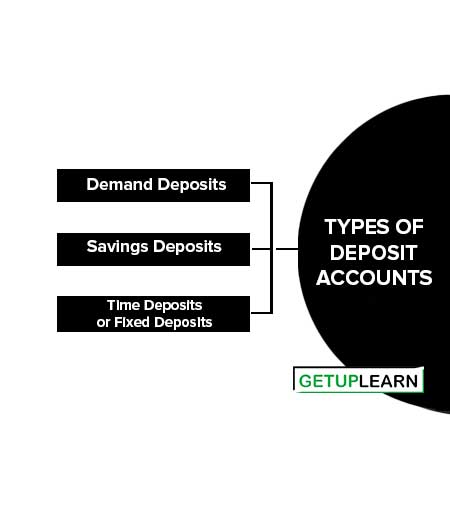

Types of Deposit Accounts

These are the types of deposit accounts explain below:

- Demand Deposits

- Savings Deposits

- Time Deposits or Fixed Deposits

Demand Deposits

Demand deposits or checkable deposits are also known as current accounts. These deposits can be withdrawn by the depositor or transferred to someone else at any time. Withdrawals and transfer to third parties usually are made by cheque. No interest is paid by the bank on demand deposits.

Savings Deposits

Savings accounts aim at the promotion of thrift. Regular saving accounts can be maintained by individuals and not profit institutions. Saving accounts do not have specified maturity dates or size limits. The accounts terminate when the holders decide.

In savings accounts, deposits and withdrawals are made at any time. Saving accounts are also known as “Passbook Accounts” because traditionally depositors receive a book known as a passbook in which all the entries related to deposits and withdrawals are recorded. Interest is paid on this account.

Time Deposits or Fixed Deposits

Time deposits are those deposits that are deposited with banks for a certain period of time. Banks pay higher rates of interest on these deposits. Time deposits cannot be withdrawn by cheque but must be converted into cash or demand deposits.

These deposits are specified both as to maturity and amount. Fixed deposits receipt is the most common type of time deposit. It is a receipt issued for funds deposited with the bank for a specified period of time and on which the bank pays interest if left till maturity. Some of the time deposit schemes are monthly income schemes, cash certificates, annuities, retirement schemes, recurring deposits, cumulative deposits, etc.

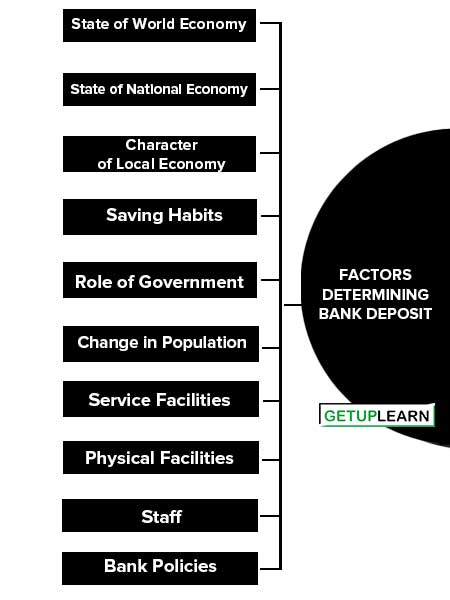

Factors Determining Bank Deposit

The factors determining bank deposit can be classified into two categories i.e., external factors and internal factors:

- State of World Economy

- State of National Economy

- Character of Local Economy

- Saving Habits

- Role of Government

- Change in Population

- Service Facilities

- Physical Facilities

- Staff

- Bank Policies

- Competitive Interest Rates

- Location

- Momentum of an Easy Start

External Factors

External factors emerge from the environment and surrounding areas in which banks have to operate. External factors are those factors which are beyond the control of the banks. These factors are discussed briefly below:

- State of World Economy

- State of National Economy

- Character of Local Economy

- Saving Habits

- Role of Government

- Change in Population

State of World Economy

The globalization of the economy means the integration of the Indian economy with the world economy. As the globalization of the economy takes place, global factors will influence the level of deposits in Indian banks either directly or indirectly.

For example, a higher rate of interest and better opportunities in India will attract NRI deposits in Indian banks or vice-versa.

State of National Economy

The level of deposits with the banks is also influenced by the prevailing conditions in the country. During periods of boom and prosperity, there is more demand for credit from businessmen leading to an increase in deposits including derivative deposits.

On the other hand, during the period of decline, the demand for loan decreases and the process of credit contraction sets in and derivative deposits shows a sharp decline.

Character of Local Economy

The level of deposits with banks is also influenced by the character of the local economy. The local economy is also influenced by the general economic conditions prevailing in the country to some extent. The deposits of a bank operating in a local area will be affected by the peculiar characteristics of that region.

Saving Habits

The savings of the economy will be an important factor in deciding the level of bank deposits. The level of deposits of banks will depend upon the habits of savings of the population. Saving s can be held in financial assets like currency, bank deposits, Government’s small saving schemes, provident funds, life insurance contributions, deposits with other financial institutions, Government securities, equities, and bonds.

The deposits can be increased by targeting the organized market saving which are idle or wasted or used in creating assets. Therefore, the attitude and habits of the population regarding the use of their savings will be an important factor in determining deposit levels.

Role of Government

The central, state, and local governments also influence the level of deposits with banks. The government plays the role of promoter in providing economic and social infrastructure which is very essential for the economic development of the country. The government itself has been playing an important role by directly participating in trade and industry.

Change in Population

The migration of people from one place to another also affects the level of deposits with banks. Therefore, changes in population can have a direct effect on bank deposits. For example, the deposits must have been shifted with the migration of people from Punjab due to militancy.

Internal Factors

Internal factors are related to the internal conditions of a bank such as physical facilities, staff, services rendered, policies and financial position, etc.

The internal factors are controllable factors that can be changed by the management of the bank according to changing working environment and working conditions. The important internal factors are mentioned below:

- Service Facilities

- Physical Facilities

- Staff

- Bank Policies

- Competitive Interest Rates

- Location

- Momentum of an Easy Start

Service Facilities

the level of deposits of a bank is influenced by the service facilities provided by the bank such as long banking hours, overdraft facilities, locker facilities, quick collection of cheques, discounting bills, teller facilities, taking less time in the operating account, ATM service facility, quick transmission of funds, etc.

Physical Facilities

The physical facilities such as building structure, comfortable sitting arrangements, comfortable counters, décor, proper lighting, ventilation, arrangement for drinking water, fresh air, etc., play an important role in attracting customers.

Staff

Bank personnel should be friendly and efficient in the performance of their job. A bank will be in a better position to attract more deposits than its competitors whose staff is kind and cooperative with the customers. A lot of emphasis is laid on good public relations by the banks.

Banks hold training programs for their staff to tell them how to deal with customers. Most of the banks have set up public relation department and customer service cells to live up to the expectations of the deposits.

Bank Policies

policies have an influence on the confidence of the public, which is very important for attracting more deposits. Public confidence is the biggest asset of a bank. Bank policies regarding loans, investments, and other matters provide an important yardstick to judge the competence and capacity of the management.

A bank may enjoy increased deposits because of its favorable policies and strategies toward its customers.

Competitive Interest Rates

A commercial bank that provides high-interest rates is in a position to attract more deposits than its competitors. The Reserve Bank of India has opined that interest rates influence the quantum of deposits.

Location

The level of deposits also depends on the location of the branch of the bank. People generally prefer to deposit their money in those branches which are located near to their residence.

Momentum of an Easy Start

Generally, an old established bank has an advantage over the new banks in attracting more deposits. People generally prefer to deal with those banks with which their parents have accounts. Once such ties are established, they are difficult to break.

FAQs About the Bank Deposit Management

What is the importance of deposit management?

The importance of deposit management is:

1. Life Blood of Banks

2. Basis of Lending

3. Mobilizing of Saving

4. Investment in Government Securities

5. Role of Intermediary

6. Contribution to Developmental Activities.

What are the types of deposit accounts?

These are the major three types of deposit accounts: 1. Demand Deposits 2. Savings Deposits 3. Time Deposits or Fixed Deposits.

What are the factors determining bank deposits?

The factors determining bank deposits are: 1. State of World Economy 2. State of National Economy 3. Character of Local Economy 4. Saving Habits 5. Role of Government 6. Change in Population 7. Service Facilities 8. Physical Facilities 9. Staff 10. Bank Policies.